Kenya's real estate boom under scrutiny amid rising money laundering, terror financing cases

The Financial Reporting Centre is tasked with identifying proceeds of crime and fighting money laundering under the Proceeds of Crime and Money Laundering Act.

Nairobi and its surrounding areas have seen a significant construction boom in recent years, fueled by high-value transactions and minimal regulatory oversight—conditions that, in some cases, have previously been linked to money laundering (ML) and terror financing (TF).

One such case involved the Financial Reporting Centre (FRC), which received suspicious transaction reports concerning a foreign construction firm with two local subsidiaries in Kenya involved in major infrastructure projects.

More To Read

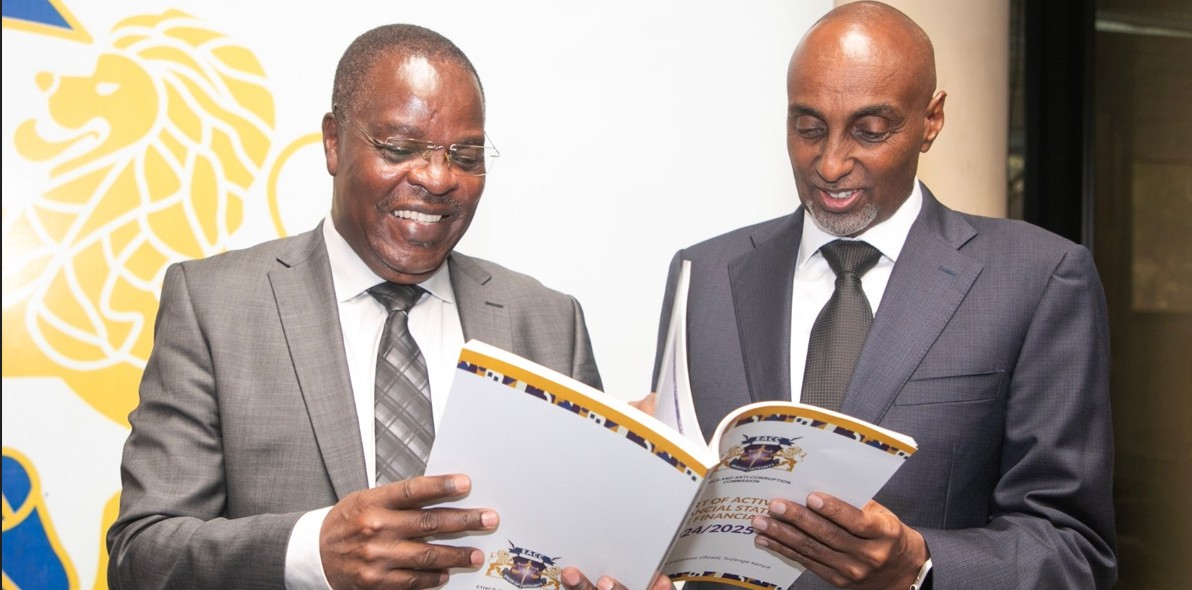

- EACC targets money laundering to remove Kenya from global crime watchdog’s grey list

- How ATPU busted prominent lawyer over alleged terror financing linked to ISIS

- Five charged with defrauding Social Health Authority of Sh17.5 million

- Four African countries delisted from money laundering watchlist, Kenya still flagged

- More SACCOs register with FRC to fight money laundering, terrorism financing

- Kenya losing over Sh79 billion annually to undervalued imports, says NTA

"The directors of the three related companies hatched a scheme of evading taxes through making fictitious payments. They used company employees to register shell companies that were used to raise invoices claiming to be suppliers of construction materials. The shell companies recruited businesses which were dealing in hardware and construction materials. They subcontracted them to make the supplies. Part of the funds that were paid to the shell companies were withdrawn in cash, converted into foreign currencies, while a smaller portion was paid to the suppliers," FRC notes in its annual report.

The centre developed a report and disseminated it to the Kenya Revenue Authority (KRA) for tax assessment for all the entities involved which then conducted investigations and established that the firm and its subsidiaries were involved in a complex tax evasion scheme that entailed claiming of value added tTax (VAT) through inflated and fictitious invoices.

"This was with the aim of reducing their tax abilities. The entities raising the invoices were shell companies with no known business operations," the report adds, as an example of money laundering cases in the country.

In another example of terror financing, the Asset Recovery Authority (ARA) received a financial intelligence disclosure from the centre arising from analysis of a suspicious transaction report (STR) filed by a local bank.

Financing Houthi militias

"The intelligence disclosure was on an individual residing in Kenya who received USD 560,000 from a foreign national designated by the United States Department of the Treasury's Office of Foreign Assets Control (OFAC) for financing Houthi militias and instability in Yemen. The money was sent on the pretext that it was payment consideration for a house located in Mogadishu, Somalia and valued at USD 2,200,000 that the designated individual had bought from the individual."

"Investigations by ARA led to the identification and freezing of a prime residential mansion in Nairobi registered to the designated individual. ARA also froze funds held in a bank account operated by the individual, and a request was sent to the Somalia FIU to seek more information on the individual," the document adds, on the matter that has been under investigation by the Anti-Terror Police Unit (ATPU).

Identifying proceeds of crime

The Financial Reporting Centre (FRC) is tasked with identifying proceeds of crime and fighting money laundering under the Proceeds of Crime and Money Laundering Act (POCAMLA).

The law requires reporting institutions to submit suspicious transaction reports (STRs) and cash transaction reports (CTRs) to the Centre, helping it track illegal financial activities.

Under this mandate, the FRC now requires real estate agents to verify their clients' identities in specific situations—such as when starting a business relationship, handling one-time transactions, if there are doubts about previous identification, or if there’s suspicion of money laundering, terror financing, or related activities involving the client.

"Information to be included during the identification and verification process includes his/her identity, purpose and nature of their business or principal activity, their financial status their capacity in which they are entering the business relationship," the Real Estate Agencies Compliance Pack shows.

Identity of beneficial owner

That includes the identity of the beneficial owner in cases where the transaction is being carried out on behalf of another person.

If the customer does not appear in person, remote identification, though considered risky, can be performed. In this case, the documents they provided must be certified by a notary public.

"If you are unable to establish the business relationship or conduct the transaction, inform the Money Laundering Reporting Officer (MLRO) immediately, who will then determine if there are ML/TF indicators and if the suspicious transaction submitted to FRC is relevant," the document adds.

High-risk jurisdictions

Last month, the European Commission included Kenya in its updated list of high-risk jurisdictions presenting strategic deficiencies in its national anti-ML and counter TF rules and regulations.

The listing meant Kenya needed to up its monitoring and actions that seal these gaps to ensure compliance.

Efforts towards sealing the gaps gained momentum last year when Kenya issued new regulations, the Prevention of Terrorism Regulations, that addressed freezing of targeted financial sanctions for terrorism without delay.

In the year, the Financial Reporting Centre received 8,057 reports consisting of 5,454 STRs, 2,482 Suspicious Activity Reports (SARs) and 114 Suspicious Transaction Activity Reports (STARs) from reporting institutions and seven reports from walk-ins/whistleblowers.

"This represents a 22 per cent increase as compared to the previous year, where the Centre received 6,631 reports, with the banking sector has maintained its consistency as the primary source of STR/SAR/STARs reporting," the annual report adds.

Regulation 34 of the 2023 Anti-Money Laundering law requires all reporting institutions to report any cash transaction of US$15,000 or more (or its equivalent in other currencies), even if it doesn’t seem suspicious.

These cash transaction reports must be submitted to the Centre by the end of each week.

Top Stories Today